espp tax calculator uk

Employee Stock Purchase PlanESPP Calculator It is an online tool for tax calculation and. Total Tax As you can.

6 Big Tax Return Errors To Avoid With Employee Stock Purchase Plans

In the US theres a tax-advantaged employee stock purchase plan ESPP under which employees can purchase stock in their companies at a discount and enjoy tax benefits.

:max_bytes(150000):strip_icc()/Investopedia_EmployeeStockPurchasePanESPP_Final-41c7a310275f4bb5912cf912acdd98ca.jpg)

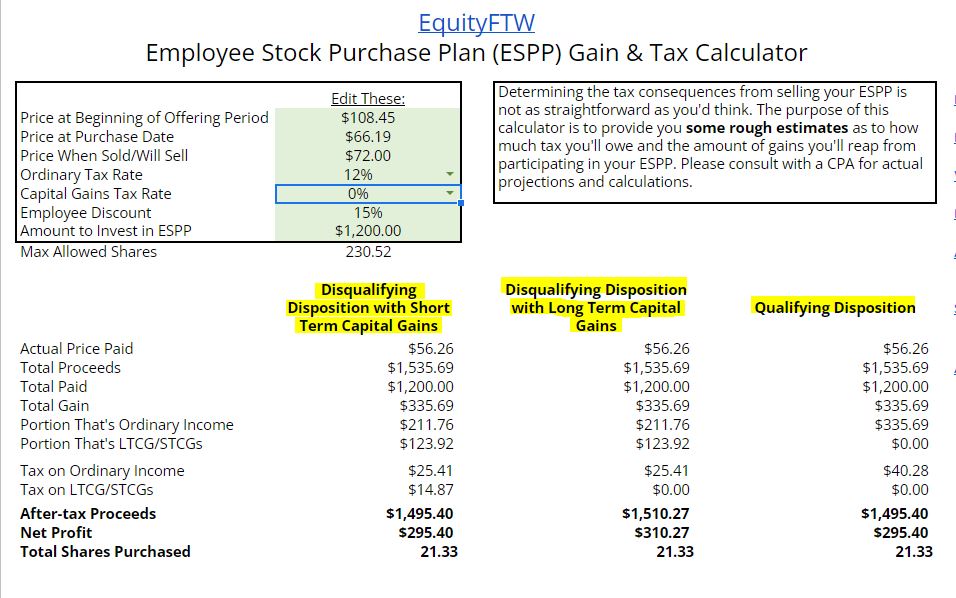

. This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription. Stamp Duty Reserve Tax SDRT when you. I find it ridiculous that I have to ask this on a public forum rather than my company but alas even the tax office when I called wasnt clear on what.

At Monday June 14th 2021 061203 AM. When developing a spread sheet solution in Excel you make decisions and. You can offset that 15 against the UK tax liability due in respect of that income that arose - fill in SA106 Foreign on your tax return and claim Foreign Tax Credit Relief.

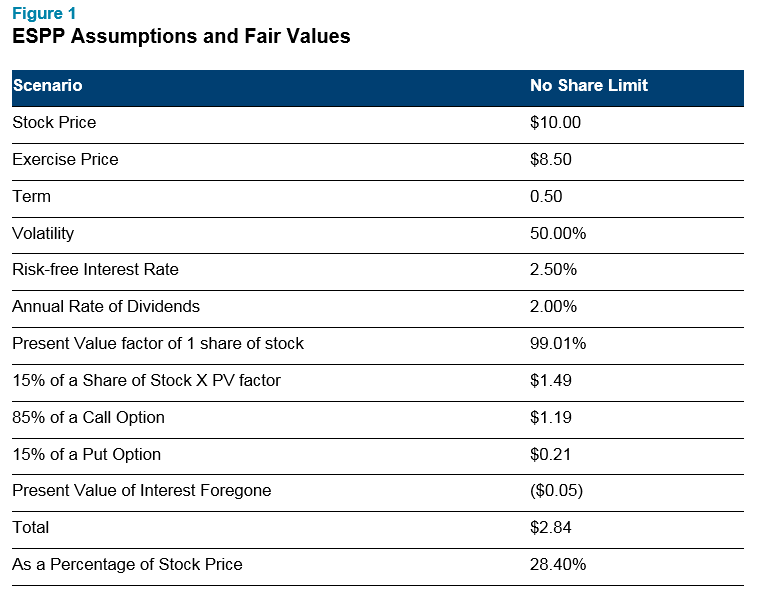

Employee Stock Purchase Plan ESPP Calculator. The ESPP tax rules require you to pay ordinary income tax on the lesser of. ESPP is common among US companies often with a framework similar to your outline.

You always want the. Your work makes Intuit successful and the Employee Stock Purchase Plan ESPP is another way to be rewarded. Employee ESPP programs.

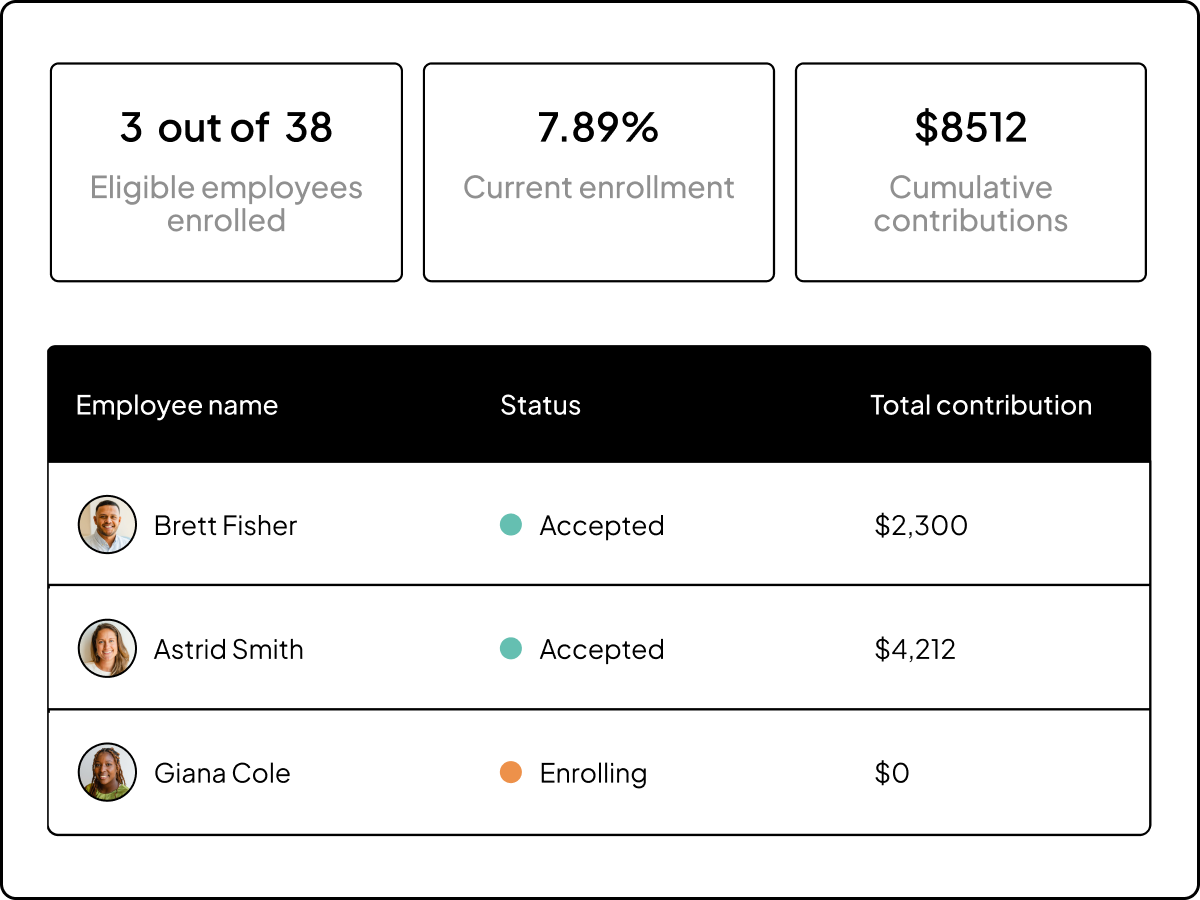

The gain calculated using the actual purchase price and. ESPP Basis current About. To help you with these calculations weve built the following ESPP Gain and Tax calculator.

In most cases the discount you received will be reported as ordinary income in Box 1 of. The discount part is. You can deduct certain costs of buying or selling your shares from your gain.

So if your discount percent is 15 as is the case with most ESPPs then your guaranteed pre-tax return is 0151-015 176 which is already quite a bit higher than 7. This tax tool is used to estimate your guaranted return rate on your ESPP based on user inputs. In the US some ESPPs allow sales of shares to be considered qualifying subject to capital gains rather.

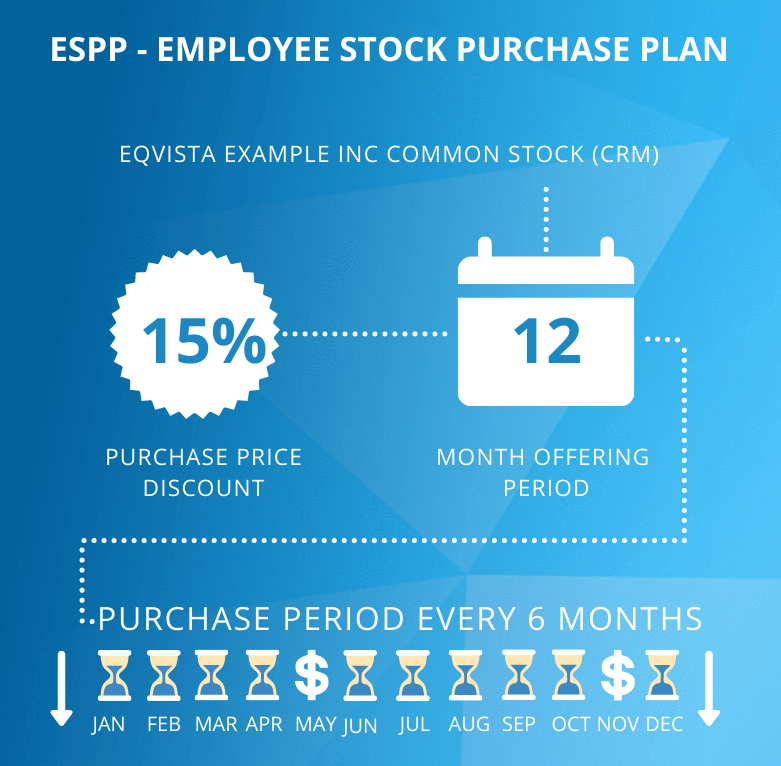

The discount allowed is normally 15 of the. The ESPP gives you the chance to own a. Employee Stock Purchase Plan.

Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming. This ESPP Gain and Tax calculator will help you 1 estimate your gains from. Contributions are accumulated during a specified period offering.

ESPP Benefit Explained. Long term capital gains 5000 2000 3000 x 300 shares Long term capital gains owed. Fees for example stockbrokers fees.

Tax advantages on employee share schemes including Share Incentive Plans Save As You Earn Company Share Option Plans and Enterprise Management Incentives. An ESPP is a way for you to purchase shares in your company through payroll deductions sometimes at a discounted price. The discount offered based on the offering date price or.

Ordinary Income Tax Owed 24 x 90000 21600. An ESPP allows employees to purchase shares of company stock through automatic deductions from their paychecks. The benefit you get from your employer is not the ability to purchase the stock but the ability to purchase the stock at a discount.

At Monday June 14th 2021 061203 AM.

Determining The Fair Value Of Your Espp Human Capital Solutions Insights

Capital Gains Tax Calculator Taxscouts

Espp Or Employee Stock Purchase Plan Eqvista

2018 Employee Stock Purchase Plans Survey Deloitte Us

An Intro To Employee Stock Purchase Plans Espp Kinetix Financial Planning

Qualified Vs Non Qualified Espps Global Shares

Year End Planning For Stock Options Restricted Stock And Espps 6 Items For Your Checklist

2018 Employee Stock Purchase Plans Survey Deloitte Us

Espp Taxes Explained Kinetix Financial Planning

Espps 101 Taxation Made Simple Part 1 Mystockoptions Com

Help In Understanding Espp And Stcg Ltcg Qualifying Bogleheads Org

The Ins And Outs Of Espp S Part 2 Fun With Taxes Financial Geekery

Your Employee Stock Purchase Plan Espp What You Need To Know Wealthtender

5 Espp Mistakes You Need To Avoid Global Shares

The Ins And Outs Of Espp S Part 2 Fun With Taxes Financial Geekery

The Minimal Investor Espp Guide And Calculator Minafi

How You Can Benefit From A Down Market Using An Employer Stock Purchase Plan Plancorp